what is fit tax on paycheck

Income that falls within each bracket is. You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer.

Solved Federal Taxes Not Deducted Correctly

You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck.

. The federal income tax is a pay-as-you-go tax. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Enter your financial details to calculate your taxes.

These are the rates for taxes due. FIT Fed Income Tax SIT State Income Tax. The federal income tax system is progressive so the rate of taxation increases as income increases.

The amount you earn. The top marginal income tax rate of 37 percent will. If we add up the two tax amounts.

In the United States federal income tax is determined by the Internal Revenue Service. For example for 2021 if youre single and making between 40126 and 85525 then you are. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year.

The IRS bases FITW on the total amount of taxable wages. FICA taxes consist of Social Security and Medicare taxes. The money withheld pays for federal income tax sometimes abbreviated as FWT on your paycheck is credited against the tax that you owe when you file your return at the end of the year.

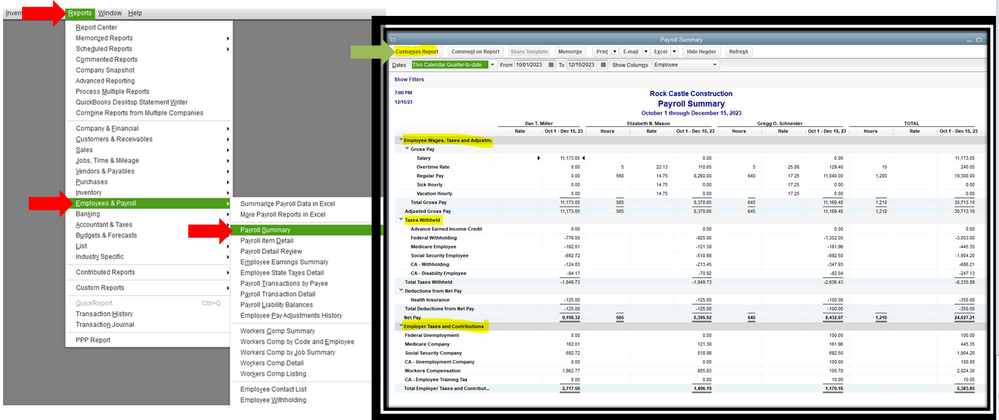

Dont Forget Employer Payroll Taxes. The income ranges the rates apply to are called tax brackets. What is Tax Withholding.

Fit stands for Federal Income Tax Withheld. This is 548350 in FIT. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E.

The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Some entities such as corporations and t.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. Federal income tax withholding varies between employees. What Do Small Business.

Your bracket depends on your taxable income and filing status. 4664 548350 1014750 total. FIT stands for federal income tax.

The Medicare tax rate is 145. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Marginal tax rates range from 10 to 37.

For example in 2018 suppose you were single and earning 9000 per year. The amount of income tax your employer withholds from your regular pay depends on two things. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

TDI probably is some sort of state-level disability insurance payment eg. Some are income tax withholding. These amounts are paid by both employees and employers.

The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. You pay the tax as you earn or receive income during the year. If you have too much withheld you receive the excess back as a tax credit but if you have too little withheld youll have to pay the difference.

For help with your withholding you may use the Tax Withholding Estimator. However they dont include all taxes related to payroll. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee.

Federal income tax rates range from 10 to 37 and kick in at specific income thresholds. Medicare is 145 for both employee and employer totaling a tax of 29. The amount your employer deducts from your check for federal income tax is based on your filing status and the amount of money you make.

The percentage of tax withheld from your paycheck depends on what bracket your income falls in. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. The information you give your employer on Form W4.

These two taxes aka FICA taxes fund specific federal programs. FIT is applied to taxpayers for all of their taxable income during the year. Specifically after each payroll you must Pay the federal income tax withholding from all employees Pay the FICA tax withholding from all employees and.

You can use the Tax. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. If youre an employee your employer probably withholds income tax from your paycheck and pays it to the IRS in your name.

69400 wages 44475 24925 in wages taxed at 22. FICA taxes are commonly called the payroll tax. The rate is not the same for every taxpayer.

Also refers to wages and benefits that. Your net income gets calculated by removing all the deductions. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

These items go on your income tax return as payments against your income tax liability. 10 12 22 24 32 35 and 37. 2022 Tax Brackets and Rates.

Federal Income Tax Withholding FITW refers to federal income tax that is withheld from wages at the time of payment. There are seven federal income tax rates in 2022. Imposes a progressive income tax where rates increase with income.

This tax will apply to any form of earning that sums up your income whether it comes for employment or capital gains. The government uses federal tax money to help the growth of the country and maintain its upkeep. There are seven federal tax brackets for the 2021 tax year.

For employees withholding is the amount of federal income tax withheld from your paycheck.

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Federal Income Tax Fit Payroll Tax Calculation Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

How To Calculate Payroll Taxes Step By Step Instructions Onpay

What Everything On Your Pay Stub Means Money

How To Calculate Payroll Taxes Methods Examples More

What Are Employer Taxes And Employee Taxes Gusto

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

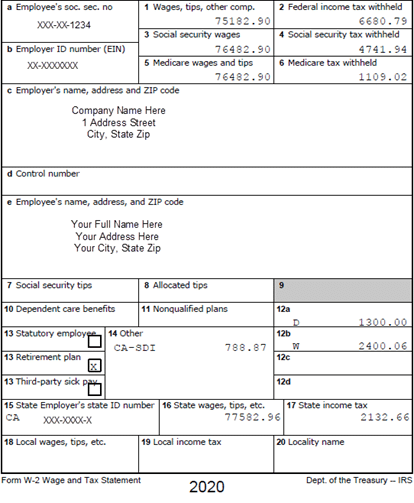

Understanding Your W 2 Controller S Office

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your W2 Innovative Business Solutions

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Understanding Your Pay Statement Office Of Human Resources